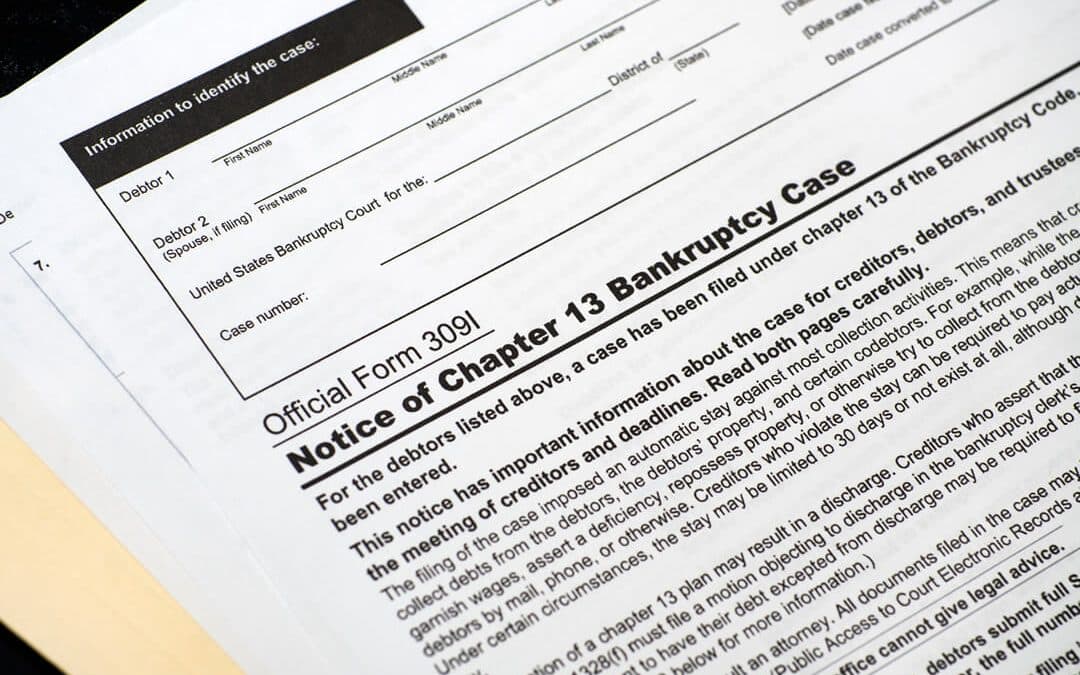

If you’re behind on bills but have a steady income, Chapter 13 bankruptcy could help you catch up by repaying debts over time. The core of a Chapter 13 case is your repayment plan. It outlines how you will repay your debts through the Bankruptcy Court. Below, we explain how payment amounts are determined, which debts must be included, and provide practical steps to create a plan that follows court rules and fits your budget.

What Is a Chapter 13 Repayment Plan?

A Chapter 13 plan is a court-approved proposal showing how you’ll pay back part or all of your debts over three to five years. You make one monthly payment to a court-appointed trustee, who then distributes it to your creditors according to the plan.

A strong, realistic plan can prevent foreclosure, stop car repossession, and provide a clear path to financial stability

How Courts Decide Your Monthly Payment

While every case is different, courts and trustees usually look at:

Your regular income: Paystubs, tax returns, side gigs, support payments—anything consistent

Necessary living expenses: Housing, utilities, food, healthcare, transportation, and reasonable childcare

Disposable income: What is left after reasonable expenses. This is the baseline of what must be included in your plan.

Plan length:

- If your income is below your state’s median, plans often last 36 to 60 months

- If your income is above the median, expect to pay off your loan in 60 months, unless you are paying back all of your creditors in full.

What creditors must receive: Certain debts have to be paid in full; others may receive a percentage based on your budget and assets.

Which Debts Are Included and How They’re Treated

Not all debts are handled the same way in Chapter 13:

- Priority debts (must be paid in full):

This includes recent income taxes, domestic support obligations (child support/alimony), and certain bankruptcy fees. - Secured debts (tied to property):

- Mortgage arrears: You can spread past-due mortgage payments over the plan while resuming regular payments directly to the lender.

- Car loans: Depending on the loan’s age and balance, you may be able to reduce interest or restructure payments.

- Unsecured debts (often paid a portion):

This typically includes credit cards, medical bills, personal loans, and other similar expenses not tied to property as collateral. The percentage they receive depends on your disposable income and any non-exempt equity in assets.

Building a Plan That Works for You and the Court

A repayment plan that fits your budget reduces the risk of falling behind on payments again. However, creating a repayment plan that complies with court rules while also fitting your budget can feel like walking a tight rope. Here are some steps to help you get started:

Gather Your Financial Information: List all your income sources, monthly expenses, and debts. Be thorough and honest.

Calculate Your Disposable Income: Subtract your necessary living expenses from your monthly income to determine your disposable income. This is the amount you can realistically allocate to debt repayment.

Prioritize Your Debts: Make sure priority debts are fully covered. Then, allocate payments to secured debts to avoid losing collateral.

Consider Plan Length: Chapter 13 plans typically last three to five years. A longer plan can lower monthly payments but extends the repayment period.

Work with a Bankruptcy Attorney: An experienced attorney can help tailor your plan to meet legal requirements and maximize your financial comfort.

Getting Help with Your Chapter 13 Bankruptcy Plan

Creating a Chapter 13 repayment plan can be complicated, but you don’t have to do it alone. Our team has decades of experience helping people craft plans that fit their unique situations. We understand the stress you’re facing and are here to guide you every step of the way.

Contact us today for a free consultation to see how we can help you create a repayment plan that fits your life and gets you on the path to financial recovery. You don’t have to face this challenge alone—we’re here to support you.